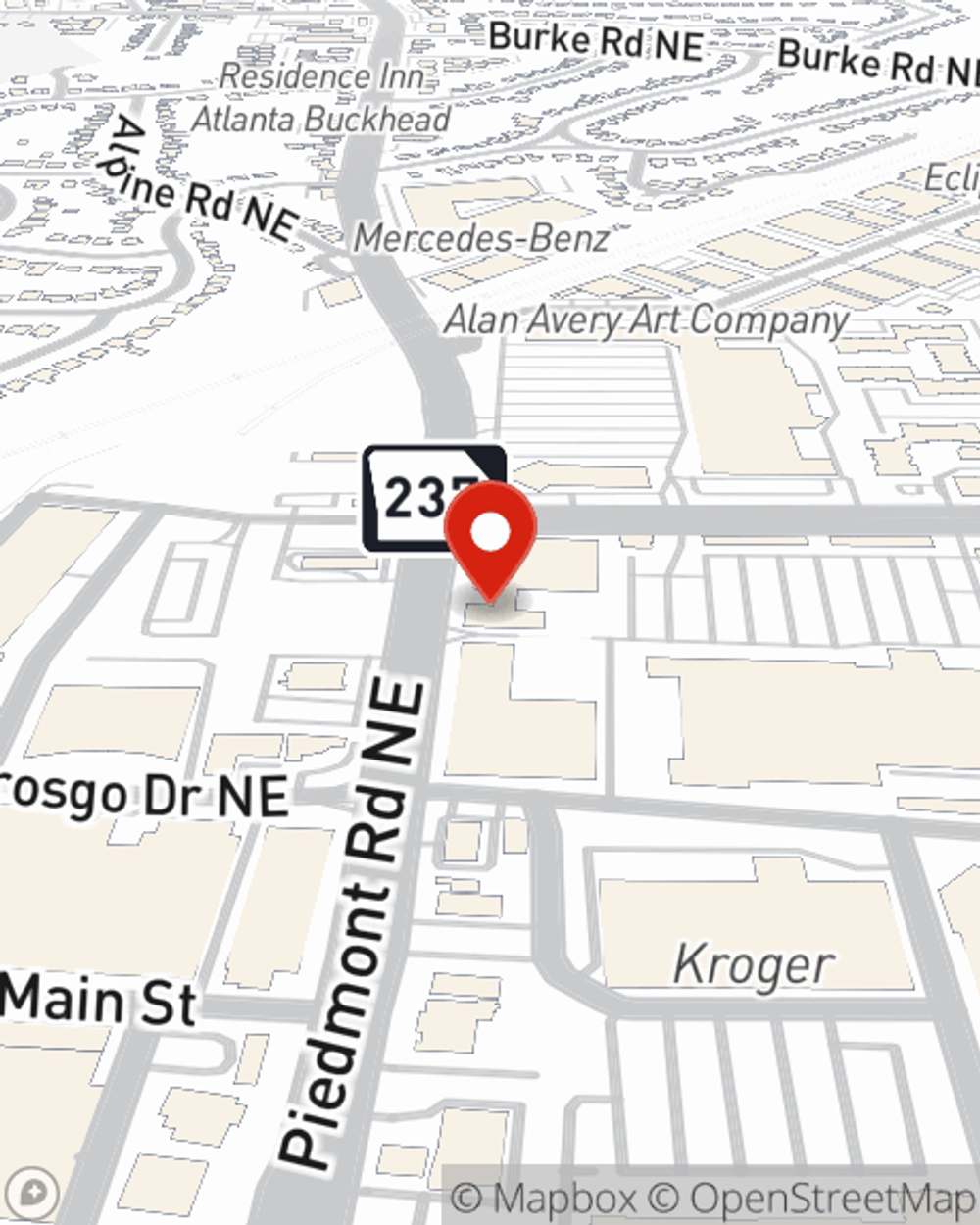

Business Insurance in and around Atlanta

Looking for coverage for your business? Search no further than State Farm agent Chris Liddell!

Helping insure small businesses since 1935

- Atlanta

- South Fulton

- Sandy Springs

- Roswell

- Johns Creek

- Alpharetta

- Marietta

- Stonecrest

- Smyrna

- Brookhaven

- Dunwoody

- Peachtree Corners

- Mableton

- Milton

- Ellenwood

- East Point

- Tucker

- Smoke Rise

- Fulton County

- DeKalb County

- Cobb County

- Clayton County

- Gwinnett County

- Douglas County

Cost Effective Insurance For Your Business.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, business continuity plans and extra liability coverage.

Looking for coverage for your business? Search no further than State Farm agent Chris Liddell!

Helping insure small businesses since 1935

Customizable Coverage For Your Business

Whether you own a pet groomer, a floral shop or a HVAC company, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Ready to talk through the business insurance options that may be right for you? Call or email agent Chris Liddell's office to get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Chris Liddell

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.